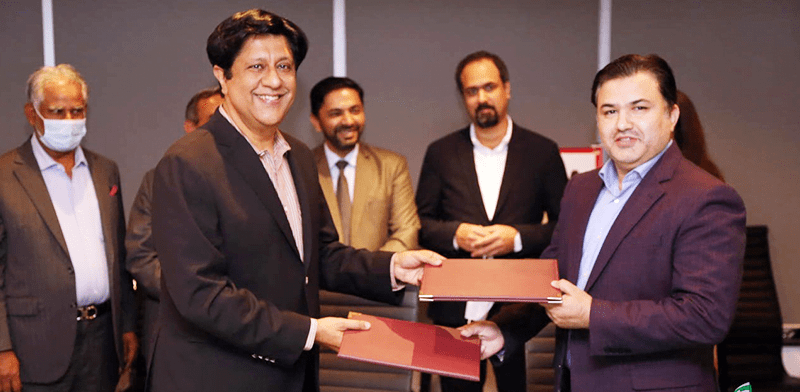

PITB – P@SHA sign MoU to promote Public-Private partnership by engaging local IT industry in Public Sector Digitalization

As part of the vision articulated by Chairman PITB Azfar Manzoor, PITB is actively working towards promoting Public-Private Partnership. One of the initiatives is PITB’s ‘Partners in Development’ program that aims at supporting the local software industry by engaging them in public sector software development work with special emphasis on digitally powered public services. In this regard, PITB and Pakistan Software Houses Association for IT & ITeS (P@SHA) signed an MoU today at Arfa Software Technology Park to promote collaboration between public and private sectors.

The MoU was signed by Chairman PITB Azfar Manzoor and Chairman P@SHA Barkan Saeed. According to the MoU, both the organizations will support each other as partners in the digitalization drive of the Punjab Government, and explore avenues of potential growth for the IT & IT enabled Services (ITeS) Industries. On this occasion Public-Private Partners Portal was also launched where local IT companies can register and share their ideas on collaborative transformation. PITB’s DG e-Governance Sajid Latif, GM IT Burhan Rasool, Founder & CEO DPL Syed Ahmed, President & CEO of InfoTech Group Naseer Akhtar and other senior officials were also present at the ceremony.

Speaking on the occasion Chairman PITB Azfar Manzoor said, “Both PITB and P@SHA are focused on collaboration to digitalize the governance ecosystem in Punjab by leveraging and sharing expertise in IT & ITeS. Through Public- Private Partnership, PITB will support the local software industry by engaging them in public sector software development projects”

Chairman P@SHA Barkan Saeed stated, “PITB is playing a vital role in the digitalization of Punjab and in promoting public-private partnership. P@SHA will encourage its members to actively engage with PITB through PITB’s ‘Partners in Development’ initiative. Both PITB and P@SHA will also work towards deliberating policy interventions necessary to foster the IT Industry in Pakistan”.

Local IT Companies and Software houses can register on the following web address. www.partners.pitb.gov.pk