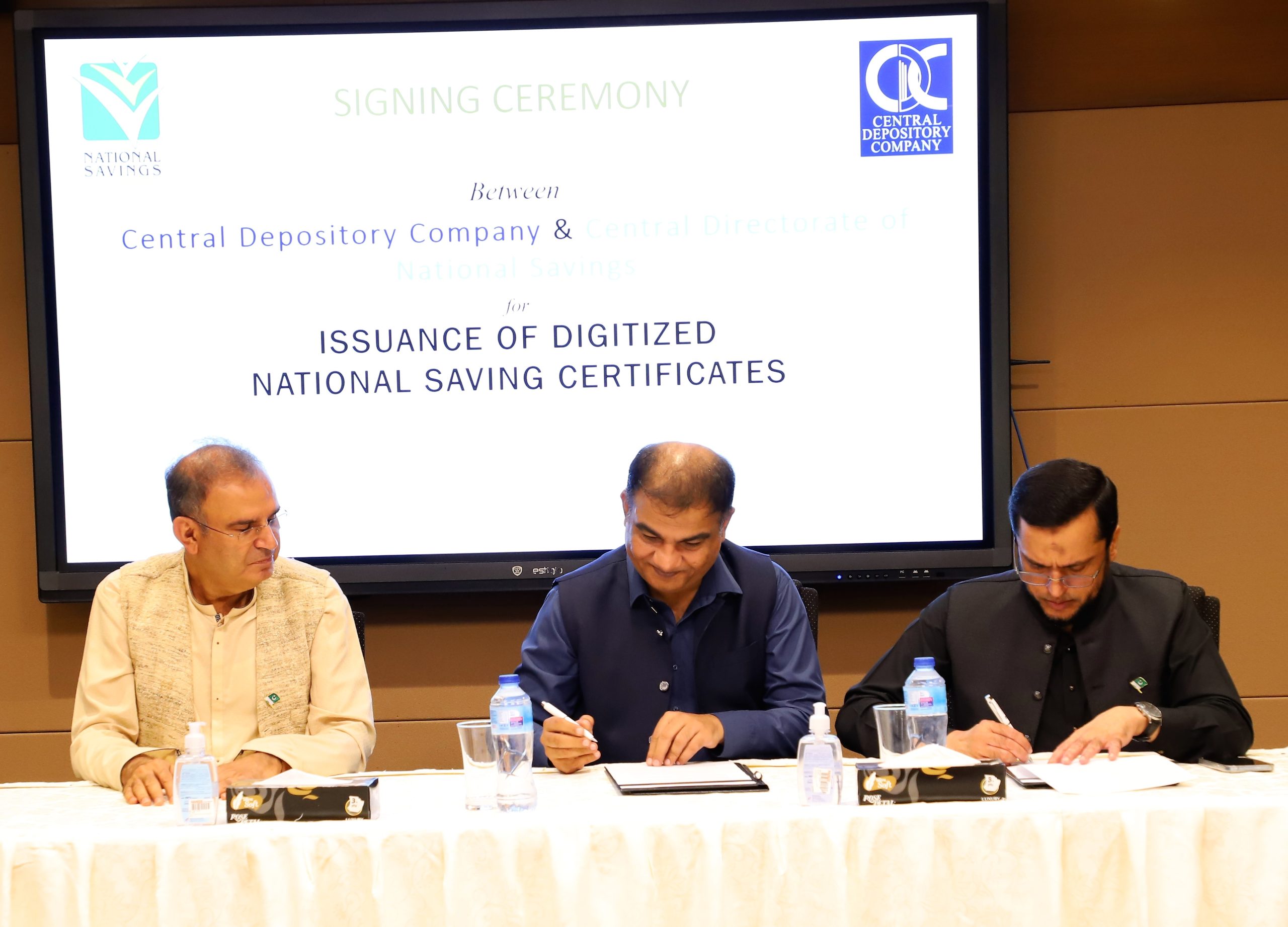

Central Directorate of National Savings (CDNS) and Central Depository Company of Pakistan Limited (CDC) signed a Memorandum of Understanding for mutually collaborating to convert and issue National Savings Certificates (NSCs) in digital form to reduce physical process flows of different transactions and develop a systematic framework through which NSCs can be inducted into the Central Depository System (CDS).

While addressing the occasion, DG CDNS, Mr. Hamid Raza commented that “The initiative is in line with CDNS’s ultimate objective of the digitization of National Savings Certificates. The recent circumstances with the shift to digitization make it all the more exigent for CDNS to undergo complete digital transformation. This platform will facilitate investors of National Savings Certificates, making it easier for them to invest in and maintain their NSCs in electronic format, thereby promoting and harvesting the savings culture in Pakistan at the grass root level.”

He said the pivotal role of innovation in economic development is undeniable, with advancements in Fintech leading the change.

Innovative tech-based processes can lead to higher productivity, reduced turnaround times, lower costs and wider outreach.

At the occasion, describing the objectives of the project, CEO-CDC Mr. Badiuddin Akber said that “The core objective of establishing a Depository in Pakistan was to dematerialize all types of financial instruments in Pakistan.

Considering this as our ultimate vision, we have dematerialized almost all types of securities in Pakistan; however, National Savings Certificates are one major aspect yet to be dematerialized. As the Depository, we feel that it is our National duty to bring our processes at par with the international best practices, and it is indeed the need of the hour that a mechanism must be developed for investors to have NSCs in book-entry form.”

Through this project, CDC will facilitate Investors, with investment in a diverse array of securities, to maintain their complete portfolio of dematerialized securities in a single account at CDC. This project will eliminate the risk of theft, loss, mutilation, etc. as well as the hassle of printing, dispatching, maintenance, etc. of physical certificates by maintaining the NSCs in electronic format in the CDS. CDC will extend the same benefits to CDNS investors as it currently provides to investors of book-entry securities in the CDS, including easy, efficient and secure transfer process for certificates, online account access and pledging facilities. At present, CDC Account can be opened through CDC offices or through digital portal of CDC from anywhere in Pakistan; however, both organizations will also work on the possibility of opening of CDC accounts through the nationwide network of CDNS offices in order to make it more convenient for investors to open CDC Account and hold National Savings certificates in digital form.

The event was also attended and addressed by Chairman CDC – Mr. Moin Fudda. The event was also attended by the senior management of CDC and CDNS.