In today’s fast-paced business environment, efficient financial management is crucial for success. Mashreq, one of the leading banks in the UAE and the Middle East, offers a state-of-the-art digital banking platform known as Mashreq Business Online. This platform provides businesses with a comprehensive suite of online banking services designed to simplify and streamline financial operations. In this article, we’ll explore the features, benefits, and impact of Mashreq Business Online on modern enterprises.

What is Mashreq Business Online?

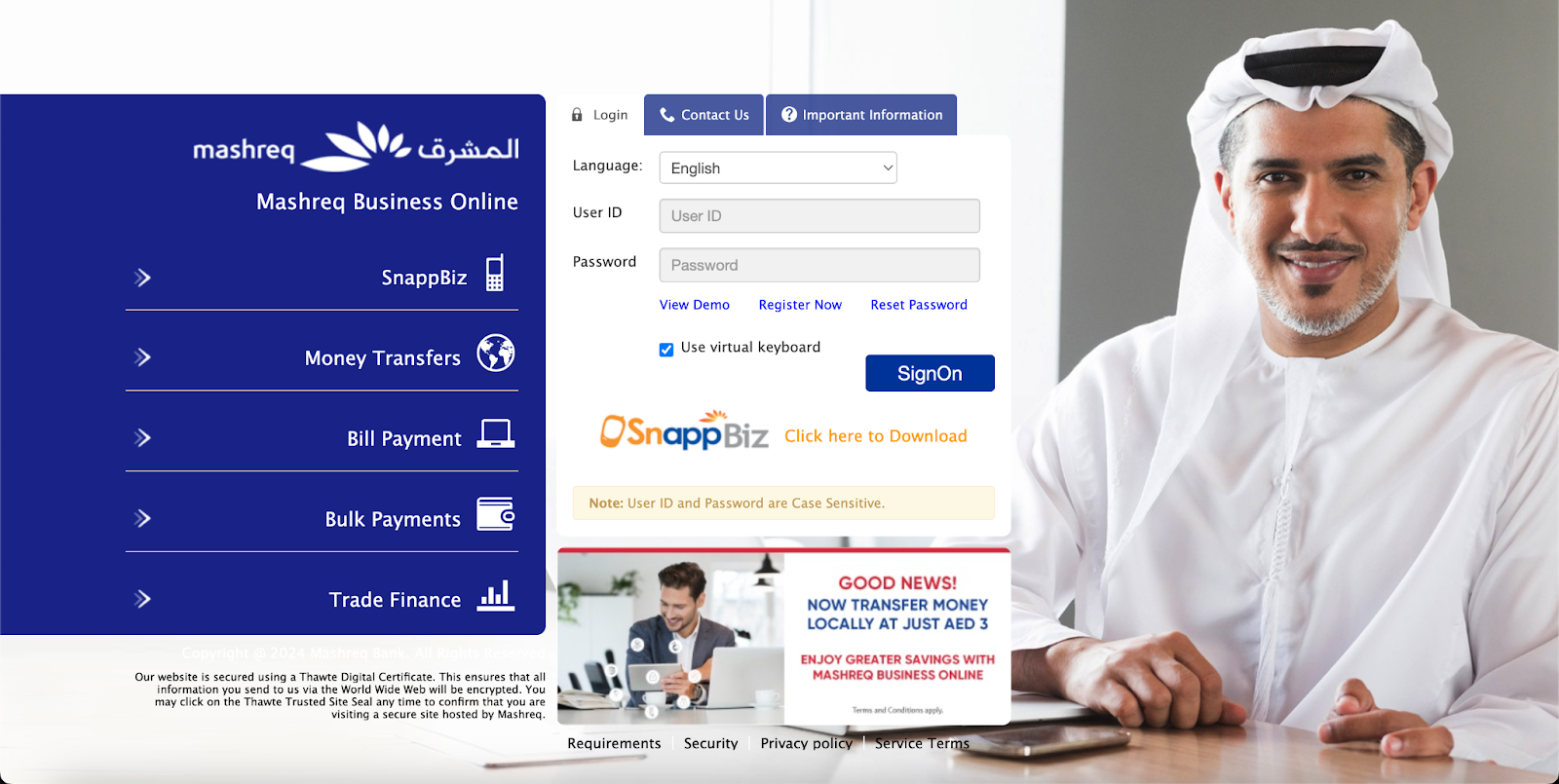

Mashreq Business Online is a secure and user-friendly digital banking platform that offers a range of financial services tailored to the needs of businesses. It enables companies to manage their accounts, transactions, and other banking activities efficiently from a single online portal. The platform is accessible via web and mobile devices, ensuring businesses can conduct their banking activities anytime and anywhere.

Key Features of Mashreq Business Online

Mashreq Business Online is packed with features that cater to the diverse needs of businesses, from small enterprises to large corporations. Here are some of the key features that make it an indispensable tool for modern businesses:

1. Account Management

With Mashreq Business Online, businesses can easily manage multiple accounts, view real-time balances, and access detailed transaction histories. The platform provides a centralized view of all accounts, making it easy to monitor and control finances.

2. Payments and Transfers

The platform simplifies payments and transfers, allowing businesses to execute local and international transactions with ease. It supports various payment methods, including SWIFT, IBAN, and UAE Direct Debit. Additionally, businesses can set up standing orders and schedule future payments, ensuring timely transactions and better cash flow management.

3. Trade Finance Services

Mashreq Business Online offers a range of trade finance services, including letters of credit, guarantees, and trade loans. These services help businesses manage their international trade transactions, mitigate risks, and optimize working capital.

4. Payroll Solutions

The platform provides efficient payroll solutions, enabling businesses to disburse salaries to employees quickly and securely. It supports Wages Protection System (WPS) payments, ensuring compliance with UAE labor laws and regulations.

5. Customizable Dashboard

The customizable dashboard allows businesses to personalize their online banking experience. Users can arrange widgets, set up alerts, and create shortcuts to frequently used features, providing a tailored experience that meets their specific needs.

6. Reporting and Analytics

Mashreq Business Online offers comprehensive reporting and analytics tools. Businesses can generate detailed reports on account activities, transactions, and cash flow. These insights help companies make informed financial decisions and plan for the future.

7. Multi-User Access

The platform supports multi-user access, allowing different team members to access the system with specific roles and permissions. This feature enhances security and ensures that sensitive financial information is only accessible to authorized personnel.

Benefits of Mashreq Business Online

Mashreq Business Online offers numerous benefits that make it an invaluable tool for businesses of all sizes. Some of the key advantages include:

1. Convenience and Accessibility

The platform provides 24/7 access to banking services, allowing businesses to manage their finances from anywhere in the world. The availability of mobile banking ensures that companies can stay connected to their accounts even while on the go.

2. Efficiency and Time Savings

Mashreq Business Online streamlines banking operations, reducing the need for manual processes and paperwork. Businesses can perform transactions, manage accounts, and access information quickly and efficiently, saving valuable time and resources.

3. Enhanced Security

Security is a top priority for Mashreq, and the platform incorporates robust security measures to protect sensitive financial information. Features such as multi-factor authentication, encryption, and secure login processes ensure that business data remains safe and secure.

4. Cost-Effectiveness

By reducing the need for physical visits to the bank and minimizing paperwork, Mashreq Business Online helps businesses cut down on operational costs. The platform’s efficient payment and transfer capabilities also reduce transaction fees and other banking expenses.

5. Better Financial Control

The platform’s comprehensive reporting and analytics tools provide businesses with valuable insights into their financial activities. This enhanced visibility allows companies to make informed decisions, optimize cash flow, and improve overall financial management.

Impact on Modern Enterprises

Mashreq Business Online has a significant impact on modern enterprises, enabling them to adapt to the digital age and stay competitive in an increasingly globalized market. The platform’s advanced features and benefits support businesses in achieving their financial goals, enhancing efficiency, and reducing costs.

In addition, Mashreq Business Online fosters innovation by providing businesses with access to cutting-edge digital banking solutions. As companies increasingly embrace digital transformation, the platform ensures they have the tools and resources needed to navigate the complexities of the modern financial landscape.

Conclusion

Mashreq Business Online is a comprehensive digital banking platform that empowers businesses with the tools and services they need to succeed in a rapidly changing world. With its user-friendly interface, advanced features, and robust security, the platform offers unparalleled convenience, efficiency, and control over financial operations. As businesses continue to embrace digital solutions, Mashreq Business Online remains a trusted partner, helping them navigate the future of banking with confidence and ease.