e-Pay Punjab, a collaborative effort of the Finance Department of Punjab and Punjab Information Technology Board, is a leap forward to digitize collections from citizens as part of the larger exercise of digitizing the financial ecosystem of Punjab and improve financial inclusion. The collections through e-Pay Punjab have sky rocketed crossing 5 million online transactions and PKR 23 billion in 18 months since the launch. Out of this, Rs. 1 Billion was collected as online payment of Traffic Challan, Rs. 13 billion as Sales Tax, Rs. 5 billion as Token Tax and Rs. 2.6 billion as Property Tax from the 3.8 million e-Pay beneficiaries.

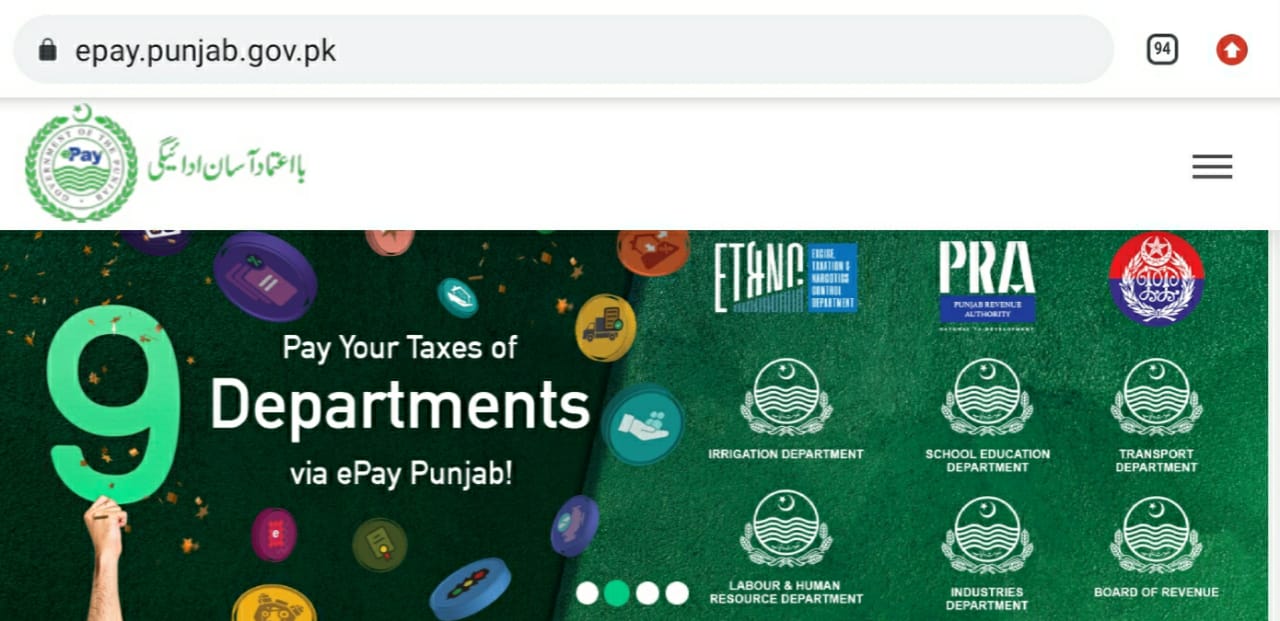

The system allows the citizens and businesses in Punjab to pay 20 taxes/levies of 9 different departments digitally from the convenience of their homes. e-Pay Punjab facilitates payments through multiple channels including Mobile Banking, Internet Banking, ATMs, Telecom agents network, TCS counters and OTC (Over the Counter) banking transaction. e-Pay Punjab app can be downloaded from the Play Store and Apple Store. Citizens are further facilitated by a 24/7 Support Helpline to resolve queries related to Online Payment of Taxes.

PITB Chairman Azfar Manzoor stated that during Covid-19 pandemic, e-Pay punjab has played an important role in facilitating citizens through online payment of Token Tax, Property Tax, e-Challan, Traffic Challan minimising physical interaction with officials. Presently Excise & Taxation, Board of Revenue (BOR), Punjab Revenue Authority (PRA), Punjab Police, Industries, Irrigation, School Education, Labour & Human Resource Department and Transport Department are integrated with the system.